Higher shipping and steel prices have pushed up the cost of wind power in the US

The cost of building onshore wind farms in the United States has risen 11-14 percent after shipping and steel prices more than tripled since 2020. Some developers have delayed projects in the hope that prices will fall. Bloomberg New Energy Finance doesn't expect capital spending to return to 2020 levels until at least next year.

Wind turbines account for 61 per cent of us onshore wind capex in the Bloomberg New Energy Finance benchmark. Steel accounts for 84 per cent of the weight of onshore wind turbine materials and 43 per cent of the value of imported wind turbines, indicating that steel and shipping price fluctuations have a strong impact on project costs.

Rising material and transportation costs have led wind turbine manufacturers to raise prices. Unwilling to take on all the risk, manufacturers are also shifting the risk to customers by linking wind turbine prices to commodity, shipping and Labour costs.

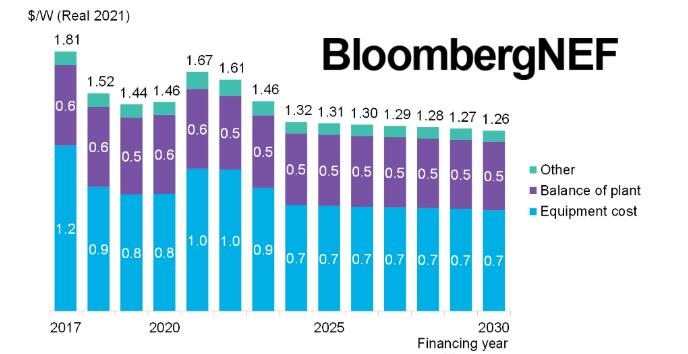

Developers must decide whether to pay more for contracts or delay projects until costs show signs of falling. Bloomberg New Energy Finance expects the increase in wind capital spending to be temporary, with the cost of financing projects expected to fall to $1.26 million /MW by 2030.